SIMPLE CFO

Make More Profit for Your Business

Fractional Chief Financial Officer & Bookkeeping Services

What We Offer – PROFIT!

Our purpose is to make your company more profitable. Period. We have helped hundreds of companies implement the Profit First cash management methodology so that they find and capture the profit they should have been enjoying all along, and then help them grow and scale.

We do this by combining Profit First with the financial expert your business needs: the Chief Financial Officer. Why? Because you must strategize making profit THE priority instead of hoping you make some. We change your business to making decisions based on financial data and Profit First rather than gut decisions.

Who Does This Work For?

Profit First is a Cash Management Strategy that Captures Profit and Ensures Owners Get Paid What They Deserve

Companies across the world are implementing Profit First to reprogram their business and realize the profit they work so hard to generate. Simple CFO helps you build this system, change the way you approach money, and provides you with a financial guide in a fractional Chief Financial Officer to get your company on the right track and making more profit than ever before.

Simple CFO has clients from a wide variety of businesses who have installed Profit First as a money management system and turned their companies into profit machines. These companies make business decisions based on accurate financial data, not gut feelings, copying what other businesses are doing, or guessing.

Pairing Profit First strategies with a fractional (part-time) Chief Financial Officer gives our clients a strong C-Suite level financial strategy expert who digs into your accounts, finds the holes, stops the bleeding, sets up Profit First accounting to maximize the profits in your existing transactions, and helps you identify the most profitable business activities to expand your future profits.

How Do We Work With You?

Simple CFO becomes your financial guide – We analyze your books, get things in order, find where you're losing your profit, and configure your business so that you are making maximum profit on every transaction you conduct.

Bookkeeping

Profit First compliant bookkeeping

Books kept up-to-date

Cash is properly accounted for

Money put in proper bank accounts

Income and expenses correctly tracked

See your business health at a glance

Never Do Your Books Again!

"Thank you so much. I appreciate yoru help with everything. I'm glad to see that you're fixing all my messes and helping me as much as possible. Thank you for that."

~ Daniel Y.

CFO Services

Link your books with our dashboard

Profit First implementation

Find your lost profit & problem areas

Build an action plan for financial success

Identify profit centers / loss categories

Direct business activities towards profit

Take Control of Your Cash

"I definitely had high expectations, but you guys have already exceeded them. And we haven't really even started. I'm pretty good at this business, but I think Chris is going to turn me into a stone-cold killer. :)"

~ Rita T.

First, we connect your accounting systems to our custom, proprietary dashboard. We analyze and identify how your profit was lost, clear up problem accounting issues, and develop an Action Plan to recover profit and prevent future lost profit from occurring.

Second, Profit First is implemented to properly manage cash flow, ensuring you get paid regularly and per your needs. The system correctly manages capturing profit while handling expenses, including changing how debts are incurred and carried if necessary.

Next, we analyze your business to identify the most profitable activities and most costly activities, so that you can adapt your business to primarily conducting profitable activities and minimizing low profit activities. Most activities involve the same or similar efforts to complete transactions; the difference in identifying and selecting profitable activities can be signficant double digit profit gain.

Finally, we optimize your business by helping you, as the CEO, make business decisions based on solid financial data rather than gut feelings or hunches. You as the CEO can view the health of your business at a glance, and scaling/expansion is available at a controlled rate so that the business does not incur significant debt working to expand and grow.

Are you ready to take control of your profit? Click below and find out:

Who Is Profit First Perfect For?

BUSINESS OWNERS

marketing agencies

retail businesses

real estate investors

COACHES

TRAINERS

contractors

Consultants

many, many, more!

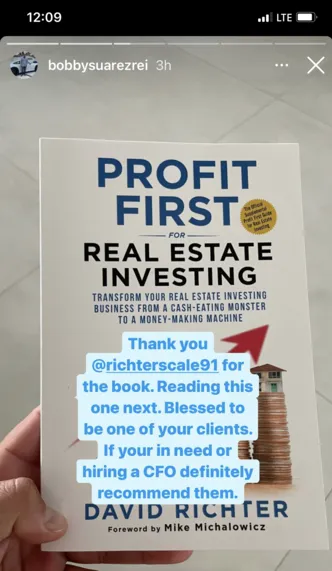

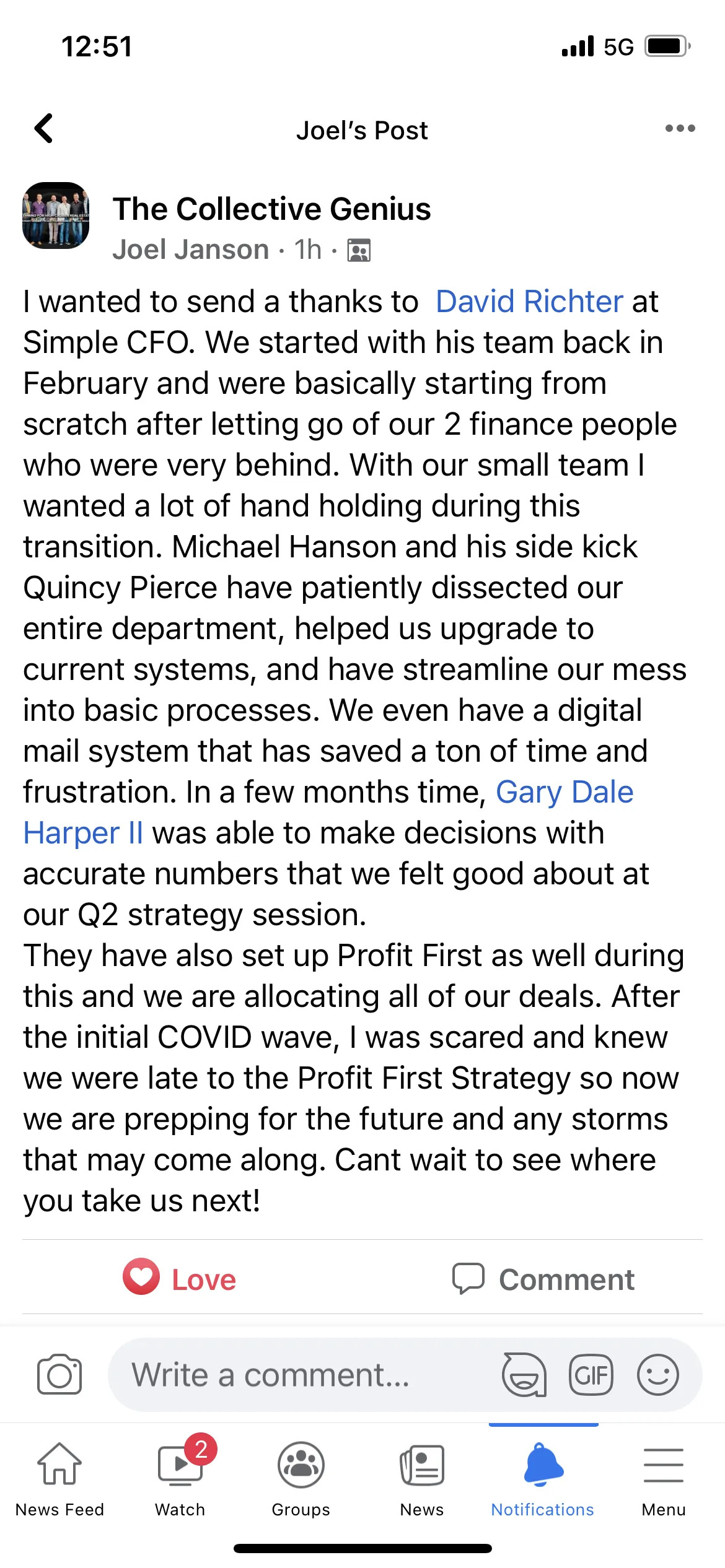

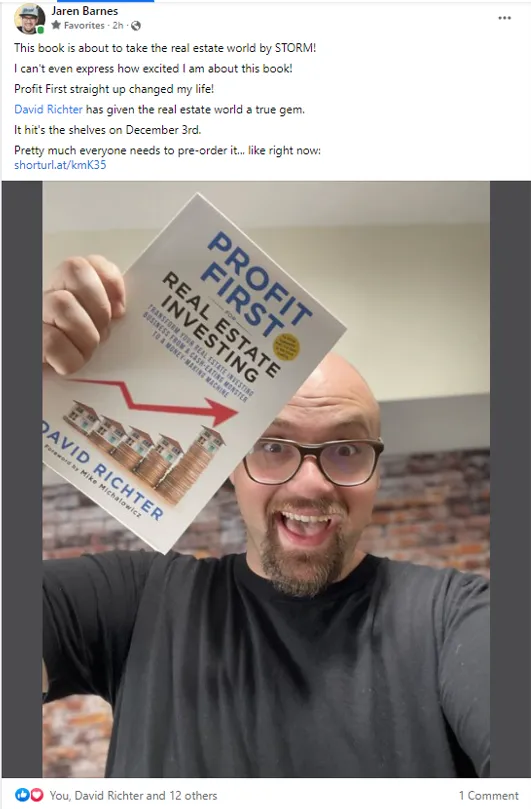

What Our Clients Are Saying

Profit First for REI Book FREE!

You Need More Profit

More Revenue ≠ More Profit

Profit comes from making it your priority.

Most businesses prioritize revenue, not profit.

With Profit First, you can finally enjoy the business you have built and reap the rewards.

"David Richter is about to transform your life. I know it because he has put that transformational power within these pages. A lifetime of knowledge is in these pages.

"Your job is simple: Read it and do it. So get started, right now, in this moment. Your life is about to be transformed by this book."

forward, profit first for real estate investING

Mike Michalowicz

THE CREATOR OF PROFIT FIRST

FREE Tools to Help You Get Started

Profit First

for Real Estate Investing

WHAT PEOPLE ARE SAYING...

“Guys, I am 39 years old and for 34 years of my life I couldn’t sleep at night until I added the profit first model from Simple CFO in my life. I feel like I’m just starting to understand finances at almost 40 and this is why hiring a fractional CFO is so important”

Pace Morby - Founder of The SubTo Community

SimpleCFO has changed the trajectory of our business and our lives.

Not only does SimpleCFO care about the bottom line, but they care more about how it impacts me, my investment strategies, and everything.

Vance Courtney – Founder of SOS Home Offers

If you’re willing to put in the work and if you want the clarity in your business and in your numbers [SimpleCFO] is definitely worth investing in. It is really the best money I’ve invested in at any time in our business.

Ralph Fredella – Owner of I’ll Buy Your House Today

SimpleCFO has changed the trajectory of our business and our lives.

Not only does SimpleCFO care about the bottom line, but they care more about how it impacts me, my investment strategies, and everything.

Vance Courtney – Founder of SOS Home Offers

SimpleCFO was my obvious choice... it was an amazing experience talking to David and having him walk me through the onboarding process and then matching me with Rebecca Howell based on my specific needs... it was a very custom-tailored experience that I absolutely loved... they really helped me get granular with my numbers, create the profit first method... and applying that to my business has really transformed how I feel and how I approach business...

I have peace of mind now, and it was worth every single penny.

Frank Chen - CEO, Affiliate Incubator

I've been working with Michael and Lori at SimpleCFO... they have been nothing but a blessing for the different businesses that myself and my partner Pace Morby run.

We had so many cash flow issues before... but after getting started with SimpleCFO we adopted the Profit First principles and were able to start giving ourselves owner's comp, profit pay, and still be investing in the deals that we want to!

Cody Barton - CoFounder, StartVirtual.com

It makes you feel good to know that you’re working with somebody you can trust… And because of David, SimpleCFO, and knowing my numbers — I’m now a millionaire!

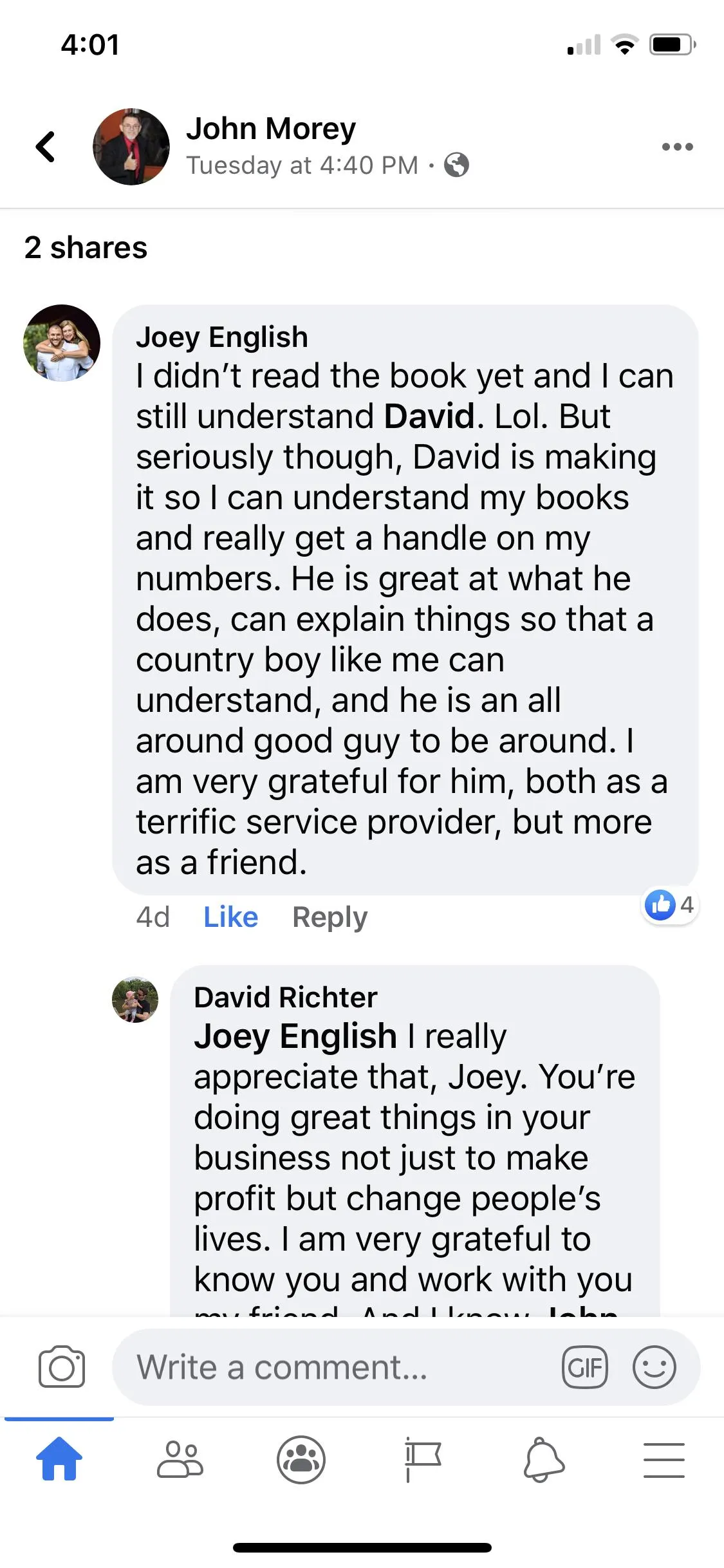

Joey English – Founder of Focus Property Solutions LLC

It’s not an exaggeration to say that David Richter changed the trajectory of my life… SimpleCFO legitimately changed my business, my kids lives, and my family will literally benefit for generations.

Rich Lennon – Owner at RVA Property Solutions

SimpleCFO has been a game changer for our business. We know we have the money for the bills that we need when they come up each month.

Kevin Thomas – Founder of Liberty Real Estate Solutions

David Richter – I love the guy. Super kind, go-giver spirit. The Profit First model has helped our businesses drastically… [and it] changes the trajectory of what your business is going to do.

Casey Ames – Owner and CEO of Taylor Jene Homes Inc.

If you are serious about profitability…work with SimpleCFO Solutions! David and his team have the skills and tools to drive your business forward to ensure profitability.

Mike Michalowicz – Author of Profit First, Founder of Profit First Professionals

Why should you work with David Richter and his team? It’s simple – you don’t know what you don’t know. David Richter understands the Profit First philosophy. He understands not just how you make money, but how you structure it, how you keep it, and how you organize it. That’s what high-level entrepreneurs really need.

Matt Andrews – Ringleader at Family Mastermind

I had no idea how much I was making and I was paying the price. I was running from deal-to-deal like a chicken with my head cut off. All that changed when I got a fractional CFO to run my business… Now I have the clarity and focus to run my business like a true CEO.

Todd Toback – Chief Visionary Officer at Get It Done House Buyers Inc.

Who Is Simple CFO?

David Richter, CEO of Simple CFO and author of Profit First for Real Estate Investing

I worked in real estate investing and diagnosed the entire profit problem. Companies I worked for closed 25 deals and spent like they closed 26. That means no profit, debt spending, and a business that is on track to go bankrupt. I knew there had to be a solution...

The key was planning for profit, then strategizing around it. That may sound obvious, but no one does it. In fact, most business owners just do deals and hope there is money left in the account at the end of the month (there isn't).

Profit First is the magic pill that cures all negative balance sheets. We reverse the formula for handling money – you take your profit first from every transaction and move it to a separate account. Then all expenses must fit within what is left. We do this for every sale, every time, and you see your profit growing in real time!

How to Get Profit First in Your Business

Let's Find Your Lost Profit and Get You Making More Money with Profit First!

The Only Thing You Have to Lose is the Profit You're Already Losing!

Helping business owners make more profit and pay themselves what they deserve using Profit First.

QUICK LINKS

SERVICES

OTHER

© Copyright 2026. Simple CFO, LLC. All Rights Reserved.