PROFIT FIRST

FOR REAL ESTATE INVESTORS

PODCAST

Have a Profit First Story to Tell? Be on our Podcast!

profit first for real estate investors

The Episodes

David Richter and Dean Rogers on Profit First

A Career in the NFL to Founding Profit in Real Estate Investing with Dean Rogers

November 18, 2025

In this episode, I’m joined by Dean Rogers—former NFL player turned real estate investor, coach, and community builder. Dean opens up about the moment he walked away from the NFL, the painful identity loss that followed, and how real estate became the path to financial and personal freedom.

We explore the mental, emotional, and financial rollercoaster Dean went through—from blowing $250K early in his career to now leading a thriving real estate business and coaching program. He shares how discipline from football translated into real estate, why trying to do it all alone almost destroyed him, and how collaboration and mentorship ultimately led to success. This episode is packed with hard-won wisdom and real talk on what it takes to build a life and business you love.

Featured Posts

Why Every Growing Business Needs a Human CFO (And How They Help You Succeed)

As businesses grow, the money side of things becomes harder to manage. There are more bills to pay, more sales to track, more taxes to plan for, and more decisions that can affect your future. ...more

cfo ,Cash Flow &Profit First

December 10, 2025•6 min read

Why Ignoring Cash Flow Can Sink Your Business (and How a CFO Can Save It)

Running a business is exciting. You get to create, sell, and serve customers. But behind all of that, money has to move in and out smoothly. That movement is called cash flow—and it’s one of the most ... ...more

cfo ,Cash Flow Profit First &AI

October 02, 2025•4 min read

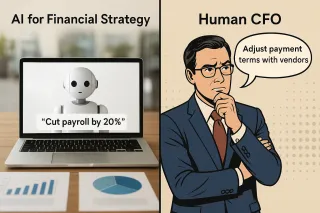

The Hidden Dangers of Using AI for Your Business’ Financial Strategy

Many business owners are turning to AI to make financial decisions, whether built into their software services or using ChatGPT, etc. The problem is that AI is not a replacement for a human CFO, and c... ...more

cfo ,Cash Flow Profit First &AI

August 21, 2025•6 min read

When Debt Becomes a Problem

Running a business is hard work. Business owners take out loans or borrow money to buy equipment, vehicles, real estate, or pay bills during slow months. Valid expenses, but If the debt piles up and i... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 15, 2025•6 min read

Are You Running Your Business Without a Map?

Running your business without a financial plan is like driving without a map. Many businesses grow quickly in the beginning. But after that first growth spurt, they stop planning. They don’t have a cl... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 03, 2025•6 min read

How to Take Back Control When Costs are Out of Control

When your business grows fast, it’s easy to pile on overhead like office space, extra staff, new equipment, and other fixed costs. These expenses don’t go away when business slows down. In fact, they ... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

June 24, 2025•5 min read

David Richter Discusses the Psychology of Smart Investing with Etinosa Agbonlahor

The Psychology Behind Smart Investing with Etinosa Agbonlahor

November 11, 2025

In this episode of the Profit First for REI Podcast, I’m joined by Etinosa Agbonlahor—a real estate investor, behavioral economist, and the host of the Her First House podcast. Etinosa brings a unique blend of corporate financial insight and personal real estate experience to the table. From working in publishing and banking across continents to designing large-scale financial behavior interventions, her journey is anything but ordinary.

We dive into the psychology of money, why most people don’t follow good financial advice, and how to design systems that actually help people take action. Etinosa also shares her path into real estate, how she built her portfolio from abroad during the pandemic, and why she intentionally slowed down her investing for the sake of peace and sustainability. Whether you’re just starting out or looking to scale with clarity, this episode will give you a powerful perspective on financial decisions—from mindset to execution.

David Richter Talks Finance with Kevin Choe

The Creative Finance Playbook That Took Kevin from Broke to 7 Figures with Kevin Choe

November 4, 2025

In this episode, I sit down with Kevin Choe—a 23-year-old real estate investor who’s done over 150 deals using creative finance, all within two years of getting started. Kevin opens up about his humble beginnings, dropping out of college, scraping together stimulus checks for mentorship, and how that leap of faith changed his life.

We dive deep into the mindset, systems, and strategic shifts that helped him rise from $100 to $15K/month—and then to building a scalable business with seller-financed multifamily deals. Kevin shares what it means to bet on yourself, why mentorship was worth every penny, and how bringing in a CFO helped him step fully into the visionary role of his business.

David Richter Talks Notes with Eddie Speed

Create Passive Cashflow without Dealing with Tenants with Eddie Speed

October 28, 2025

In this episode, I welcome back my good friend and legendary note investor, Eddie Speed. With over 50,000 notes purchased and more than 25 years of teaching under his belt, Eddie is known as the “Note King” for a reason. If you’re a tired landlord looking for less stress and more cash flow—or if you’re simply seeking a smarter, more passive way to invest in real estate—this episode is going to open your eyes.

We dig into how note investing compares to traditional rentals, why now is the perfect time to pivot, and what makes a “good” note in today’s economy. Eddie also shares insider strategies on seller financing, leveraging, and how to generate long-term passive income without the tenant headaches.

David Richter Talks Tax-Free with Mark Willis

How to Earn Tax-Free Income Without Tenants, Toilets, or Turmoil with Mark Willis

October 21, 2025

In this eye-opening episode, I bring back Mark Willis, a certified financial planner and expert in non-traditional wealth strategies, to discuss one of the most overlooked wealth-building tools for real estate investors: dividend-paying whole life insurance—also known as the “Bank On Yourself” concept. Mark shares how you can leverage this strategy not just for life insurance, but to create tax-free income, fund your investments, and even replace traditional rentals with guaranteed returns.

If you’re tired of the uncertainty of tenants, toilets, and taxes—or you’re looking to diversify your portfolio while protecting your wealth—this episode is a game changer. We cover the powerful ways to use whole life insurance for liquidity, tax efficiency, and even legacy planning. Get ready to look at your financial strategy in a whole new way.

David Richter Talks with Michael Bartolomei

How Top Investors Use Texting to Build Predictable Profits with Michael Bartolomei

October 14, 2025

In this episode, I’m joined by Michael Bartolomei of Launch Control to talk about why texting isn’t just a marketing tactic—it’s a foundational part of a scalable business strategy. If you’ve been treating SMS as a one-off tool or cutting it when money gets tight, you’re missing out on one of the most powerful ways to create consistent deal flow in real estate investing.

Michael brings deep insight from working with investors at every level—from solo operators to large teams—and he shares what separates those who scale from those who stall. We dive into the systems, mindset shifts, and tactical frameworks that will help you stop chasing leads and start building a real engine for growth.

David Richter Talks with Sharon Lechter, Co-Author of Rich Dad, Poor Dad

Sharon Lechter: Why Your Mindset Is Sabotaging Your Money & How to Fix It

October 7, 2025

In this powerful episode, I sit down again with the legendary Sharon Lechter—author of Rich Dad Poor Dad, Outwitting the Devil, and Exit Rich—to explore how entrepreneurs can shift their mindset, take control of their finances, and build lasting wealth even in uncertain times. We go deep into how to mentor your kids on money, why foundational business systems matter more than flashy marketing, and how to shift from owning a job to owning real assets.

Whether you’re worried about market instability, struggling to scale your business, or just looking for clarity and focus, this conversation is packed with actionable steps to turn fear into momentum. Sharon shares timeless wisdom, personal stories, and tangible resources that can help you thrive financially and personally.

David Richter Speaks with Jordan Fleming

Jordan Fleming: Why Your Phone System Is Costing You Deals (and How to Fix It)

September 30, 2025

In this episode, I sit down with Jordan Fleming the co-founder of smrtPhone and author of Click Call Scale, to talk about the one tool most investors overlook when trying to grow their business: the phone system. We dive into how deep CRM integration, intentional data use, and AI-driven sales tools are transforming the way real estate investors manage teams, follow up with leads, and stay compliant.

If you've ever thrown money at leads and wondered why your close rate is still weak, Jordan’s insights are the wake-up call you need. From avoiding six-figure fines to converting more sellers through thoughtful follow-up, this episode is packed with actionable strategies that will change how you view your phone—and your business.

David Richter Talks with Gino Barbaro

Gino Barbaro: The 3 Pillars That Took Me from Burnout to Multifamily Millions

September 24, 2025

In this episode, I sit down with Gino Barbaro—multifamily investor, author, educator, and co-founder of Jake & Gino. We dive deep into the mindset, systems, and financial foundations that helped him scale from a pizza shop owner to a real estate mogul managing over 2,000 units.

Gino shares the critical role that Profit First played in helping him gain control over his personal and business finances—and why so many investors fail not from lack of opportunity, but from lack of clarity and discipline. This episode is a masterclass in building a long-term, values-driven real estate business that actually creates wealth and freedom.

David Richter Talks Rebuilding with Caleb Luketic

Caleb Luketic: Rebuilding After Losing $550K in His Real Estate Business

September 16, 2025

What happens when your business loses over half a million dollars—and it’s your own fault? In this episode, I’m joined by my good friend and client Caleb Luketic, who shares how he climbed out of a $550K loss through strategy, grit, and knowing his numbers. We dive deep into the raw, behind-the-scenes reality of being on the brink—and how clarity, accountability, and CFO support helped him rebuild a thriving business in just 18 months.

Caleb doesn’t just talk about the comeback. He reveals the specific shifts in strategy that saved his business—like choosing assignments over flips, getting creative with owner financing, and radically narrowing his marketing focus to only what worked. If you’re in real estate and feeling overwhelmed, this episode will show you it’s not just possible to turn things around—it’s profitable.

How to Get Profit First in Your Business

Let's Find Your Lost Profit and Get You Making More Money with Profit First!

The Only Thing You Have to Lose is the Profit You're Already Losing!

Helping business owners make more profit and pay themselves what they deserve using Profit First.

QUICK LINKS

SERVICES

OTHER

© Copyright 2026. Simple CFO Solutions, LLC. All Rights Reserved.