PROFIT FIRST

FOR REAL ESTATE INVESTORS

PODCAST

Have a Profit First Story to Tell? Be on our Podcast!

profit first for real estate investors

The Episodes

David Richter Talks with Chad Harris

Chad Harris: How Chad Bought 80 Rental Units Without a Bank or a W-2

September 9, 2025

In this episode, I chat with Chad Harris, a former missionary turned full-time real estate investor, who’s quietly mastered the art of building a rental portfolio without ever using traditional bank financing. Chad walks us through how he raised millions in private money—starting with zero savings and a $2K/month income—and why less interest is actually more attractive to lenders.

From structuring win-win deals to understanding what private lenders actually want, Chad breaks down his strategy with a calm, no-hype approach that cuts through the noise. If you’ve been scared to ask for money, or you’re stuck using your own cash, this episode will completely change how you think about raising capital.

David Richter Talks with Isabelle Guarino

Isabelle Guarino: Turn One House into $20K/Month with Residential Assisted Living

September 2, 2025

In this episode, I sit down with Isabelle Guarino, CEO of Residential Assisted Living Academy, to talk about one of the most overlooked and impactful real estate investment opportunities in the market today. We dive deep into how owning and operating a residential assisted living home can create lasting income, build generational wealth, and provide critical care for a rapidly growing aging population.

Isabelle shares how her late father pioneered the RAL movement, how the industry exploded during COVID as families turned away from big-box facilities, and why this business model is not just recession-resistant—but recession-proof. From licensing to staffing, cash flow to exit strategies, this episode is packed with real-world insights and an inspiring mission: to do good and do well.

Featured Posts

Why Every Growing Business Needs a Human CFO (And How They Help You Succeed)

As businesses grow, the money side of things becomes harder to manage. There are more bills to pay, more sales to track, more taxes to plan for, and more decisions that can affect your future. ...more

cfo ,Cash Flow &Profit First

December 10, 2025•6 min read

Why Ignoring Cash Flow Can Sink Your Business (and How a CFO Can Save It)

Running a business is exciting. You get to create, sell, and serve customers. But behind all of that, money has to move in and out smoothly. That movement is called cash flow—and it’s one of the most ... ...more

cfo ,Cash Flow Profit First &AI

October 02, 2025•4 min read

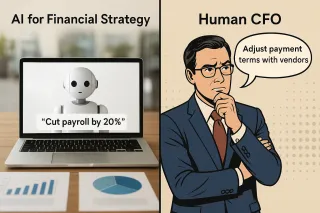

The Hidden Dangers of Using AI for Your Business’ Financial Strategy

Many business owners are turning to AI to make financial decisions, whether built into their software services or using ChatGPT, etc. The problem is that AI is not a replacement for a human CFO, and c... ...more

cfo ,Cash Flow Profit First &AI

August 21, 2025•6 min read

When Debt Becomes a Problem

Running a business is hard work. Business owners take out loans or borrow money to buy equipment, vehicles, real estate, or pay bills during slow months. Valid expenses, but If the debt piles up and i... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 15, 2025•6 min read

Are You Running Your Business Without a Map?

Running your business without a financial plan is like driving without a map. Many businesses grow quickly in the beginning. But after that first growth spurt, they stop planning. They don’t have a cl... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 03, 2025•6 min read

How to Take Back Control When Costs are Out of Control

When your business grows fast, it’s easy to pile on overhead like office space, extra staff, new equipment, and other fixed costs. These expenses don’t go away when business slows down. In fact, they ... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

June 24, 2025•5 min read

David Richter Talks with Mike Webb

Mike Webb: Why My Real Estate Company Didn’t Collapse When I Did

August 26, 2025

In this episode, I sit down with Mike Webb—firefighter, real estate investor, and co-founder of Jump Capital—to talk about the moment life forced him to stop… and how it reset everything. After a terrifying medical event took him out of commission for months, Mike shares what it taught him about being intentional, building a real business (not just a job), and why profit without purpose means nothing.

We get into how his business survived without him, the power of partnerships, and how Profit First helped him and his partner Bill Kenny finally pay themselves on purpose. Whether you’re chasing financial freedom or just trying to stop the entrepreneurial chaos, Mike’s story is a powerful reminder of what matters most.

David Richter Talks with Joe Theriault

What a $250K Monthly Burn Rate Taught Joe About Running a Real Estate Business

August 19, 2025

In this episode, I catch up with real estate investor and operator Joe Theriault, who pulls no punches about the gritty reality of scaling a company from solo hustler to a 20-person powerhouse. Joe shares the lessons, sacrifices, and systems that got him from being burnt out on renovations to building a culture-first business with a massive vision—and the finances to back it up.

We get into everything from top-grading talent and building true loyalty, to navigating cash flow chaos with Profit First, and why he now invests heavily in coaching, leadership, and legacy. If you want the raw behind-the-scenes of what it actually takes to build a sustainable, profitable business in real estate, this is it.

David Richter Speaks to Bill Kenny

Making More Lending in Real Estate Over Flipping Properties

August 12, 2025

In this episode, I reconnect with my friend and client Bill Kenny, who shares his powerful transformation from grinding through dozens of flips and transactions a year to building a more sustainable and scalable business. Bill opens up about how burnout pushed him to pivot into commercial real estate and start his own hard money lending company, Jump Capital.

We unpack how he transitioned from being in the trenches to funding deals for others, and how implementing Profit First (with help from Simple CFO) gave him the clarity and structure to grow with confidence. If you’ve ever wondered when it’s time to level up your strategy—or how to lend without losing sleep—this episode has the roadmap.

David Richter Speaks to Matt Kamp

The Deal-Closing Machine with Maximum Profit

August 5, 2025

In this episode, I’m joined by Matt Kamp from DealMachine—an expert in real estate lead generation, partnerships, and all things systems. If you’ve ever struggled with keeping your deal flow consistent or wondered how tech can help you scale your investing business, this one’s a must-listen. Matt shares how DealMachine evolved from a simple tool for driving for dollars into a full-fledged real estate marketing platform that helps investors find, finance, and flip properties with ease.

We also dive into Matt’s personal investing journey—from doing deals with a full-time job to implementing Profit First from day one with his business partner. He opens up about their process, how they celebrate wins, and why intentionality and clarity in finances have been crucial to their success. Whether you’re looking to close your first deal or streamline your back-end systems, you’ll walk away with actionable insights.

David Richter Speaks with Nicole Purvy

God, Goals & Money Framework: A Spiritual System for Financial Success

July 29, 2025

In this episode, I sit down with the dynamic and unstoppable Nicole Purvy—a serial entrepreneur who transformed early setbacks into a real estate empire and a deeply impactful coaching platform. From being escorted out of her finance job for launching a YouTube channel, to teaching herself web design, building a digital marketing agency, and eventually founding one of the most respected real estate communities in Philadelphia, Nicole’s story is a masterclass in reinvention and purpose.

We talk about how she built her real estate knowledge from the ground up, helped thousands invest with confidence, and implemented Profit First to get control of her growing income. But it’s her raw and honest discussion about hitting rock bottom, healing from trauma, and discovering her God-centered framework for abundance that makes this episode one you don’t want to miss.

David Richter Talks with Joe & Jenn Delle Fave

Surviving a Down Market with Creative Finance Strategies

July 22, 2025

In this high-energy episode, I welcome back two of my favorite recurring guests, Joe and Jenn Delle Fave—real estate pros who are in the trenches every day. If you’re feeling the effects of a down market, this episode is your survival guide. We break down actionable strategies you can implement today, especially if your go-to tools like wholesaling or flipping aren’t hitting like they used to. Joe and Jenn explain how adding creative finance to your investor toolkit can be a total game-changer.

But it’s not just strategy—we talk about the real stuff too. From building teams and family life to handling fear and taking messy action, Joe and Jenn open up about the wins, the hard lessons, and what it really takes to thrive as an investor. Whether you’re new or seasoned, this episode will inspire you to simplify, pivot, and make smart moves—especially in turbulent times.

David Richter Speaks with Jonas Medrano

Scaling to a $12M Real Estate Business with the Profit First Playbook

July 15, 2025

In this episode, I sit down with Jonas Medrano, a powerhouse of discipline and drive who took the principles he learned from sports and fitness and applied them masterfully to real estate investing. From wholesaling his first property to scaling a $12 million business from his dining room table, Jonas’ story is not just about financial success, it’s about the mindset and grit it takes to get there.

We dig into how Jonas adopted the Profit First philosophy early in his business and how that has fueled his high-profit margins and lean operations. He also opens up about his new passion for coaching and the exact type of driven individuals he’s looking to mentor. If you’re looking for inspiration and actionable insights from someone who’s done the work and built a thriving real estate business from the ground up, this episode is for you.

David Richter Speaks with Alex Pardo

Using Profit First to Pivot into Self-Storage Investing

July 8, 2025

In this episode, I sit down with Alex Pardo, a self-storage magnate who transitioned from a thriving wholesaling and house-flipping career to building wealth through self-storage facilities. Alex shares his raw and honest story of realizing he’d built a stressful business that left him feeling stuck, and how he used Profit First principles to regain control of his finances and peace of mind — both in business and at home with his wife.

We unpack what it really takes to pivot into self-storage, why he believes it’s one of the most overlooked but recession-resistant assets available to investors, and how Profit First helped him save aggressively for big capital expenses. Alex also discusses who should consider investing in storage, what makes a deal profitable, and how adopting a disciplined money system strengthened his marriage and overall life satisfaction.

David Richter Talks Notes with Patrick Franz

Stop Chasing Deals & Invest Like a Bank with Notes

July 1, 2025

What if you could stop chasing deals and start collecting payments like a bank? In this eye-opening episode, I sit down with Patrick Franz, founder of Note Investor University, to explore the power and potential of note investing—an often-overlooked strategy that’s changing the game for savvy real estate investors. Patrick pulls back the curtain on how owning mortgage notes can create more security, scalability, and true passive income than traditional rentals or flips.

Whether you’re tired of toilets, tenants, and turnover or just looking for smarter ways to grow your portfolio, this episode is packed with insight. We talk about the difference between owning real estate and owning the paper behind it, how to find and evaluate notes, and how you can leverage private capital to build a cash-flowing note portfolio—even if you’re brand new to the space.

How to Get Profit First in Your Business

Let's Find Your Lost Profit and Get You Making More Money with Profit First!

The Only Thing You Have to Lose is the Profit You're Already Losing!

Helping business owners make more profit and pay themselves what they deserve using Profit First.

QUICK LINKS

SERVICES

OTHER

© Copyright 2026. Simple CFO Solutions, LLC. All Rights Reserved.