PROFIT FIRST

FOR REAL ESTATE INVESTORS

PODCAST

Have a Profit First Story to Tell? Be on our Podcast!

profit first for real estate investors

Episodes

David Richter Talks Law with Chris Johnsen

When You Actually Need a Lawyer in Your Real Estate Business

January 20, 2026

In this episode, I sit down with business attorney Chris Johnsen, who brings a refreshingly honest take on when investors really need legal help—and when they don’t. With a background in real estate, litigation, and corporate counsel, Chris knows firsthand how legal blind spots can cost you big. But he also gets the hustle. He’s not here to sell legal services you don’t need—he’s here to help you think like a business owner.

We dive into when to engage a lawyer (hint: not always day one), what contracts investors mess up the most, and the risks of using boilerplate docs or DIY operating agreements. Chris also tackles hot topics like non-competes, asset protection, and the legal lines you might be crossing without even realizing it—especially in syndications.

David Richter Talks with Aaron Letzeiser

Most Real Estate Investors Are Overpaying for Insurance

January 13, 2026

In this episode, I sit down with Aaron Letzeiser, co-founder of OB Insurance, to talk about one of the most overlooked (and overpaid) areas in real estate investing—insurance. If you’ve ever felt frustrated by rising premiums, confusing policies, or slow claims, this episode will be a game-changer.

Aaron shares why insurance is getting more expensive (especially in markets like Florida and Texas), what most investors get wrong about their coverage, and how OB is changing the way real estate pros manage risk. We dive into how OB uses tech to create fast, transparent quotes, the difference between replacement cost and actual cash value, and how to take back control of your costs—without sacrificing protection.

Featured Posts

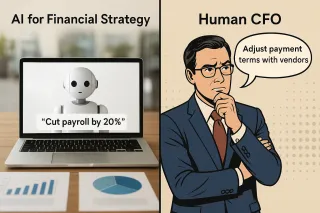

Why Every Growing Business Needs a Human CFO (And How They Help You Succeed)

As businesses grow, the money side of things becomes harder to manage. There are more bills to pay, more sales to track, more taxes to plan for, and more decisions that can affect your future. ...more

cfo ,Cash Flow &Profit First

December 10, 2025•6 min read

Why Ignoring Cash Flow Can Sink Your Business (and How a CFO Can Save It)

Running a business is exciting. You get to create, sell, and serve customers. But behind all of that, money has to move in and out smoothly. That movement is called cash flow—and it’s one of the most ... ...more

cfo ,Cash Flow Profit First &AI

October 02, 2025•4 min read

The Hidden Dangers of Using AI for Your Business’ Financial Strategy

Many business owners are turning to AI to make financial decisions, whether built into their software services or using ChatGPT, etc. The problem is that AI is not a replacement for a human CFO, and c... ...more

cfo ,Cash Flow Profit First &AI

August 21, 2025•6 min read

When Debt Becomes a Problem

Running a business is hard work. Business owners take out loans or borrow money to buy equipment, vehicles, real estate, or pay bills during slow months. Valid expenses, but If the debt piles up and i... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 15, 2025•6 min read

Are You Running Your Business Without a Map?

Running your business without a financial plan is like driving without a map. Many businesses grow quickly in the beginning. But after that first growth spurt, they stop planning. They don’t have a cl... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

July 03, 2025•6 min read

How to Take Back Control When Costs are Out of Control

When your business grows fast, it’s easy to pile on overhead like office space, extra staff, new equipment, and other fixed costs. These expenses don’t go away when business slows down. In fact, they ... ...more

cfo ,Cash Flow Profit First Budgeting &Debt

June 24, 2025•5 min read

David Richter Talks to Dave Dupuis

Owning the Deal & Decisions in Real Estate Without Giving Up Control

January 6, 2026

In this episode of the Profit First for Real Estate Investing podcast, I sit down with Dave Dupuis, one-half of the dynamic duo behind Investor Mel & Dave. Dave shares how he and his wife Mel built a thriving real estate business, owning over 250 units across five countries, without ever using joint venture partners. From his early days as a firefighter to scaling their portfolio through creative financing, Dave unpacks the mindset shifts, systems, and strategies that helped them achieve financial freedom and teach thousands of others to do the same.

We get into the nuts and bolts of using other people’s money the right way, how to protect your equity while growing fast, and the power of not giving up decision-making control. Dave also opens up about how a life-threatening car accident led them to start coaching and why keeping your business aligned with your values is the key to long-term success.

David Richter Talks with Martine Richardson

The Type of Real Estate That Builds Real Wealth

December 30, 2025

In this episode, I sit down with Martine Richardson—real estate investor, educator, and freedom advocate—to break down the real numbers behind getting out of the rat race. Martine’s story isn’t just inspiring, it’s filled with tactical advice for anyone who’s trying to create true financial freedom through real estate. From getting her car repossessed to building a portfolio that bought back her time, Martine shares how she leveraged creative financing, community, and consistency to scale her business.

We talk about the real math behind financial freedom, how different rental strategies stack up (short, mid, and long-term), and why she’d go straight to buy-and-hold if she were starting over today. If you’ve ever asked yourself “how many doors is enough?”, Martine gives you a simple framework to find your freedom number.

David Richter and Frank Iglesias Talk Business

Why Investing in Just Real Estate Isn’t Enough with Frank Iglesias

December 23, 2025

In this episode, I sit down with Frank Iglesias—a real estate investor, coach, and host of the What Worked for You podcast—to unpack the journey from chaos to clarity. Frank opens up about how burnout from his IT job led him to real estate, but also how the entrepreneurial learning curve nearly burned him out all over again.

We dive into the pitfalls of trying to do too many things at once, why real estate investing is only one part of the business equation, and how Profit First helped him regain control of his finances. Frank shares the hard lessons of jumping into new construction too early, the value of having a business coach, and why mastering the fundamentals is the only way to scale sustainably.

David Richter talks to Jason Lavender

Investing in Real Estate with NO Profits (And How I Fixed It) with Jason Lavender

December 16, 2025

In this episode, I sit down with Jason Lavender — a real estate investor and former painting contractor — who gets real about his rocky relationship with money and how Profit First finally changed his life. Jason shares the painful truth about how he ran his business by looking at his bank balance, faced constant stress despite making money, and ignored the warning signs until everything boiled over.

What makes this episode so powerful is Jason’s honesty. He didn’t get it right the first — or even the second — time he tried Profit First. But when he finally committed, delegated implementation, and surrendered access to his own money, everything shifted. We talk about how he transitioned from a chaotic hustle into a clear, structured, and profitable business, and how you can too.

David Richter talks to Eddie Wilson

Why Your First Exit Could Be the Key to Financial and Time Freedom with Eddie Wilson

December 9, 2025

In this powerful episode, I sit down with my long-time friend and serial entrepreneur Eddie Wilson — widely known as the “King of Exits” — to unpack what it truly means to build with purpose. Eddie shares how he has successfully exited over 113 companies and why his mission extends far beyond business. From navigating his first accidental exit to building a global nonprofit impacting 108 countries, Eddie walks us through how purpose, fulfillment, and systems of leadership have shaped his entrepreneurial path.

We also dive deep into his real estate journey, how he integrates tax strategy and endowments, and why legacy means creating something that can thrive without placing a burden on the next generation. Whether you’re a real estate investor, business owner, or mission-driven leader, this episode will challenge your definition of success and ignite a deeper sense of intentionality in your work.

David Richter talks to Amber Vilhauer

Creating Infinite Impact with Alignment in Your Business with Amber Vilhauer

December 2, 2025

If you’ve ever felt out of alignment in life or business, this episode will light a fire under you. I sit down with Amber Vilhauer — founder of No Guts No Glory and author of Infinite Impact — to talk about what it really takes to create purpose-driven work that actually changes lives. Amber’s not only the powerhouse who helped me launch Profit First for Real Estate Investing, but she’s also a deeply authentic entrepreneur with a remarkable journey of resilience and transformation.

Amber shares the emotional backstory that shaped her mission to help others feel heard, seen, and valued — and how that mission now fuels everything from book launches to marketing strategy. We dive into the real root of resistance, how entrepreneurs can overcome visibility fears, and why getting into alignment might be the most important step you’re skipping. If you’ve ever wondered whether your voice matters or how to make an impact beyond just growing your business, this one’s for you.

David Richter and Rich Lennon on Lending vs. Flipping

Why Lending Beats Flipping & How to Do It the Right Way with Rich Lennon

November 25, 2025

In this episode, I’m joined by one of my favorite humans and my very first Simple CFO client—Rich Lennon. Rich has done it all: from flipping houses to owning rentals, and now, he’s built a life of freedom through private lending. We unpack how he made the shift from operator to lender, what a “fractional wrap” is, and why lending has become his favorite seat at the table.

Whether you’re deep in real estate or just starting to stack cash, this episode gives you a blueprint for transitioning into lending the right way. Rich breaks down the systems, the mindset, and the returns—and shares how you can lend with both profitability and integrity.

How to Get Profit First in Your Business

Let's Find Your Lost Profit and Get You Making More Money with Profit First!

The Only Thing You Have to Lose is the Profit You're Already Losing!

Helping business owners make more profit and pay themselves what they deserve using Profit First.

QUICK LINKS

SERVICES

OTHER

© Copyright 2026. Simple CFO Solutions, LLC. All Rights Reserved.